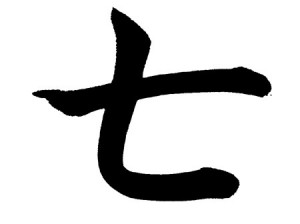

Inspired by a recent trip to Japan, here are my 7 main insights distilled from Deep Value by Tobias Carlisle, in Haiku form. Arigatou gozaimasu.

1. Risk: “A Bundle of Twigs Cannot Easily Be Broken”

Stocks perceived risky,

Find resilience when bundled.

Have fewer down years.

2. Return: Buy the “Ugliest of the Ugly”

Deep Value defies

Investment Intuition.

Ugly is Better.

3. Trust in Mean Reversion & Avoid Naive Extrapolation

Trust Mean Reversion.

Naive Extrapolation

Ignores the Base Rate.

4. Expand Your Time Horizon

Seeking to avoid

Short-term underperformance,

They’re captured by it.

5. Behavioral Biases: Your Intuition is Killing You

Three Crude Heuristics,

Lead us to poor decisions.

What feels right is wrong.

6. Use a Statistical Approach: Focus on Simple & Effective Techniques

Ben Graham’s approach:

Stick to a few Techniques and

Simple Principles.

7. Stay out of the Way: Overconfidence Leads to Reduced Performance

Our judgment misleads,

We find broken legs abound.

Stay out of the way.